Invoice Revaluation

Summary

An invoice revaluation accounts for fluctuations in prices or foreign exchange (FX) rates. This is done by revaluating open positions at the date of the revaluation, using the best-known prices, weights, assays, and foreign exchange rates. Open positions are typically locked final invoices that have not yet been revaluated; and the latest locked commercial invoice, as of the revaluation date, for despatch orders (DOs) without a locked final invoice raised during the month prior to the revaluation date. An FX revaluation displays the values of invoices and their line items in the revaluation currency at the time of invoice generation and at the revaluation date, and compares those values.

The parameters of an invoice revaluation can filter which invoices and despatch orders are included. Journal entries can be created for invoice revaluation adjustments and the journal entries can be exported to an accounting or enterprise resource planning (ERP) application.

Context

A provisional invoice is raised generally when the material is shipped. Provisional invoices reflect the value of the delivery with the best information available at the time: the invoice is calculated using a provisional price, loading weights and assays, contract terms and foreign exchange rates. However, the determination of the final amount can occur several months after the first provisional invoice is raised, according to the final quotation period. For example, a typical final quotation period could be in the month after the month of shipment. The final price could be less than the provisional price, in which case, it causes a loss for the seller, or it could be more than the provisional price, in which case, it causes a gain for the seller. This loss or gain has to be accounted for and posted to the accounting or ERP system.

The context for an FX revaluation is different. An invoice may have multiple currencies, or the currency of an invoice may be different from the currency of the accounting system. In each scenario, exchange rates are used to convert the currencies at the time of invoice generation. However, these exchange rates may change between when the invoice was generated and when the invoice is fully paid. An FX revaluation calculates the gain or loss caused by these exchange rate fluctuations. This gain or loss can be posted to the accounting or ERP system.

Purpose and Inclusions

The purpose of the invoice revaluation is to determine if there is an adjustment that must be accounted for. This is done by revaluating open positions at the date of the revaluation, using the best-known prices, weights, assays, and foreign exchange rates.

Essentially, open positions (for all invoice revaluations except FX revaluation) include:

- Locked final invoices that have not yet been revaluated (generally this will be final invoices that were raised during the month prior to the revaluation date)

- The latest locked commercial invoice, as of the revaluation date, for DOs without a locked final invoice raised during the month prior to the revaluation date

Commercial invoice types are those for which Is Not Commercial Invoice is unchecked on the Invoice Types screen. Non-commercial invoice types are never revaluated. Unlocked invoices are also never revaluated.

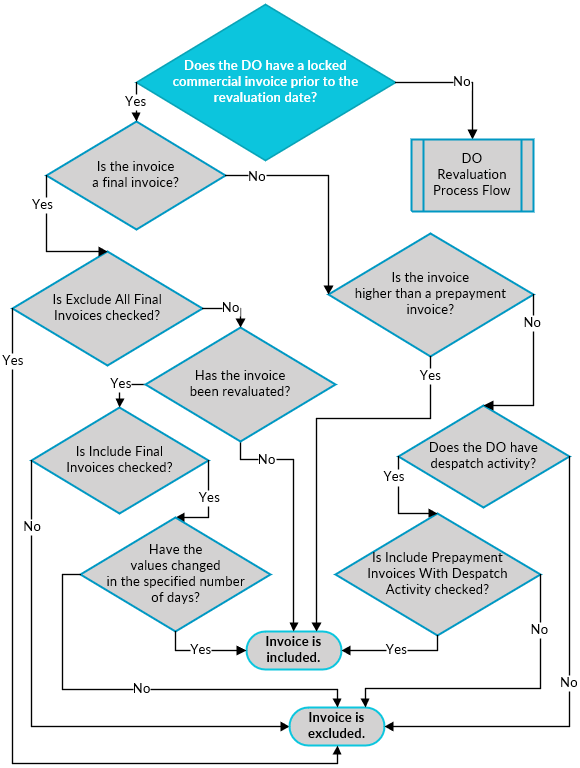

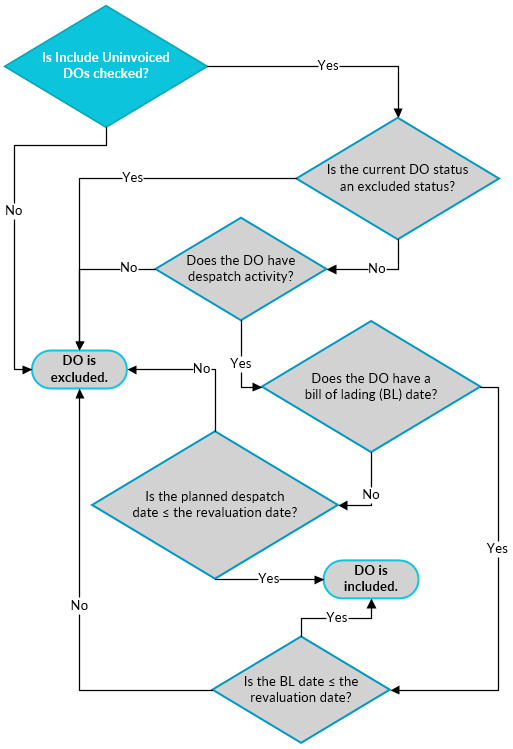

However, there are several other considerations beyond the invoice type; for example, the revaluation parameters and whether there is despatch activity associated with the DO. An example of despatch activity is when the DO is added to a despatch with loading or unloading transactions. If the despatch order snapshot shows the Weight Value Source to be anything other than Required Quantity, the DO has despatch activity. Consider the following flowcharts to determine if an invoice or DO is included in a revaluation.

Flowchart 1: Invoice Selection in a Revaluation

Flowchart 2: Despatch Order Selection in a Revaluation

If a despatch order has child despatch orders (CDOs), either the aggregated parent despatch order (APDO) / split parent despatch order (SPDO) or the CDOs can be included in the revaluation. If the Keep invoicing together checkbox is checked on the APDO/SPDO, the APDO/SPDO is included in the revaluation. If invoicing is by CDO, only the CDOs are included in the revaluation. See Parent and Child Despatch Orders.

For consignment parent despatch orders (CPDOs), only the CDOs are included in the revaluation.

Analyte quality forecast values affect despatch orders included in revaluations, but not invoices. See Analyte Quality Forecasts.

For FX revaluation, sales and purchase invoices and credit and debit notes are included. If more than one invoice exists for a despatch order (provisional, 2nd provisional, final), only the latest invoice is included; however, locked payments made for previous invoices are included and displayed with the latest invoice. If all invoices, including the latest invoice, are fully paid, then they are not included.

Invoice Revaluation Scopes

In all revaluation scopes, the contract terms used in the revaluation are the same as were applicable when calculating the original invoice. This means that if any contract terms are overridden on the despatch order, the despatch order's contract terms apply.

The latest foreign exchange rates are used in all revaluation scopes.

Full Revaluation

A full revaluation is based on nominated line items from sales or purchase invoices, using the final quotation period, and with the applicable contract terms. If updated weights or assay results are available, they are used in the revaluation. All payable analytes are included, even those for which the QP is not due. Prices can be overridden if the user has additional security right permissions. The types of line items that can be included in the revaluation are:

- Revenue

- Taxes

- Selected Charges—Select from a list of charge types or charge templates. Note, the invoice revaluation only includes optional charges if they were selected in the last locked invoice.

- Dynamic Items

If the revaluation parameters include Use Snapshot History, for each open position in the revaluation, the latest despatch order snapshot on or before the revaluation date is used:

- Weights and assays from the snapshot are used.

- If the price in the snapshot has the Final price type, that price is used.

- If the price in the snapshot has any other price type, MineMarket estimates the price but only uses prices known up until the revaluation date. (Both actual and forward prices are used as required.)

Assay Revaluation

An assay revaluation is based only on updated assay results relating to sales or purchase invoices, with the applicable contract terms. The weights and prices that were used in the calculation of the original invoice are retained in the revaluation.

Uninvoiced despatch orders cannot be included in an assay revaluation.

If the revaluation parameters include Use Snapshot History, for each open position in the revaluation, the assays are taken from the latest despatch order snapshot on or before the revaluation date.

Price Revaluation

A price revaluation is based only on updated prices relating to sales or purchase invoices, using the final quotation period, and with the applicable contract terms. The weights and assay results that were used in the calculation of the original invoice are retained in the revaluation. Prices can be overridden if the user has additional security right permissions.

The types of line items that can be included in a price revaluation are:

- Revenue

- Taxes

- Selected Charges—Select from a list of charge types or charge templates. Note, the invoice revaluation only includes optional charges if they were selected in the last locked invoice.

- Dynamic Items

Uninvoiced despatch orders cannot be included in a price revaluation.

If the revaluation parameters include Use Snapshot History, for each open position in the revaluation, the latest despatch order snapshot on or before the revaluation date is used:

- If the price in the snapshot has the Final price type, that price is used.

- If the price in the snapshot has any other price type, MineMarket estimates the price but only uses prices known up until the revaluation date. (Both actual and forward prices are used as required.)

Weight Revaluation

A weight revaluation is based only on updated weights relating to sales or purchase invoices, with the applicable contract terms. The prices and assay results that were used in the calculation of the original invoice are retained in the revaluation.

Uninvoiced despatch orders cannot be included in a weight revaluation.

If the revaluation parameters include Use Snapshot History, for each open position in the revaluation, the weights are taken from the latest despatch order snapshot on or before the revaluation date.

FX Revaluation

An FX revaluation displays the values of invoices and their line items in the revaluation currency at the time of invoice generation and at the revaluation date, and compares those values. All invoice line item types except taxes are included. For invoices that are partially paid, the FX revaluation also displays the paid amount in the revaluation currency at the time of payment and at the revaluation date, and compares those values. Pro-rata outstanding amounts (the balance) also display.

If an invoice or payment does not have a stored exchange rate stored for the revaluation currency, the FX revaluation uses the exchange rate at the invoice date or payment date.

For example:

- An invoice was generated when the exchange rate from AUD to USD was 0.7104. The invoice total is USD 366,260.79, which is AUD 515,695.19. The invoice is not yet paid.

- An FX revaluation is created for AUD, and at the revaluation date, the exchange rate was 0.7282. The invoice total is revaluated as AUD 505,967.30, which is an AUD 9,727.89 loss.

Freight Revaluation

A freight revaluation is based on freight invoices, using the rate periods that would be applicable to the final invoices.

The types of line items that can be included in the revaluation are:

- Taxes

- Dynamic Items

- Rate Details—Note, the invoice revaluation only includes rate details if they were selected in the last locked invoice.

Note: Rate details in the revaluation are matched to rate details in invoices by the Type of the rate detail. Therefore, within a rate period, each rate detail applicable to the invoice's revaluation must have a unique type.

Uninvoiced despatch orders cannot be included in a freight revaluation.

Service Revaluation

A service revaluation is based on service invoices, using the rate periods that would be applicable to the final invoices.

The types of line items that can be included in the revaluation are:

- Taxes

- Dynamic Items

- Rate Details—Note, the invoice revaluation only includes rate details if they were selected in the last locked invoice.

Uninvoiced despatch orders cannot be included in a service revaluation.

Invoice Revaluation Calculations

The following logic is used when calculating revaluation adjustments.

- The open positions that match the parameters are determined.

- The final price is recalculated:

- If the final price is based on a fixed price and that quotation pricing header is approved, that price is used. If the price is not approved and the contract has product pricing, the forward curve specified for the Product or Brand is used.

- If the final price is based on quotation period (QP) and the QP is completed before the revaluation date, the price must be obtained from the price series. If the price is not available, the revaluation is stopped and an error displayed.

- If the QP is scheduled to complete after the revaluation date, the price is obtained using the method set in the Price Sources parameter (for example, LKQ or Forward Curve).

- If the final price cannot be obtained due to there not being the necessary prices listed in the price series or forward curve, the revaluation is stopped and a message displayed.

- After the final price is obtained, the revenue is calculated using the metal content from the latest locked invoice.

- The adjustments are calculated using the following formulae:

Price Adjustment = Revaluated Price – Price of the Last Invoice

Revenue Adjustment = Revaluated Revenue – Revenue of the Last Invoice

Total Adjustment = Revaluated Invoice Value - Total Value of the Last Invoice

Note: The total adjustment includes any contract or analyte-based charges.

- The values are converted to the currency in the parameters.

This calculation is applied to every line item that satisfies the parameters (or if the revaluation is for all line items).

Invoice Revaluation Automation

Revaluations can also be run as part of an automated month-end process.